Austin Area Real Estate Market Update 2023*

Market Outlook

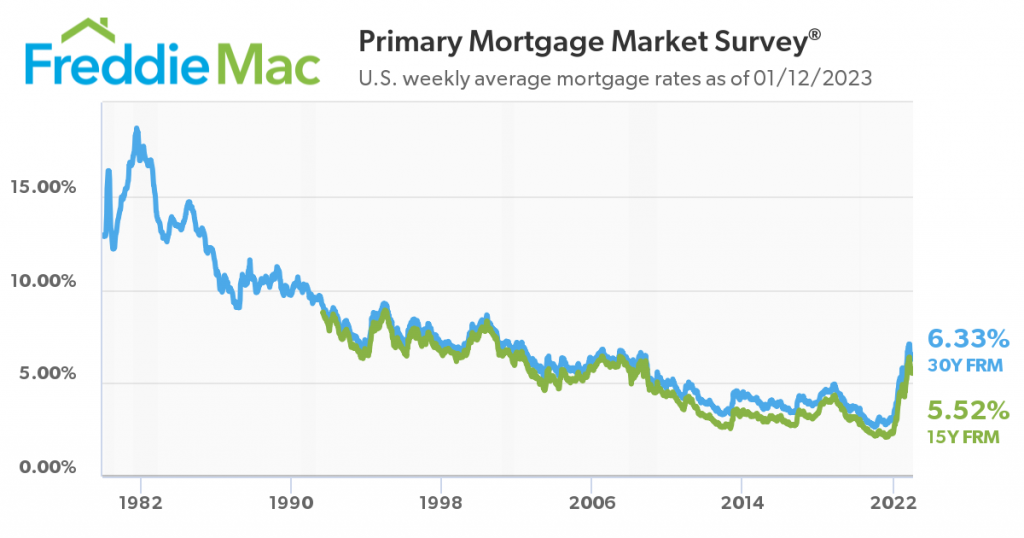

The Austin real estate market is gearing up for 2023 in 2008 fashion. Mortgage rates are hovering around the mid 6s for 30 year fixed conventional loans. The Federal Reserve is promising a teensy tiny federal funds rate increase because inflation is slowly improving, which will indirectly impact mortgage rates. The financial market is expecting some volatility until the economy outlook is clearer (Forbes, 2023).

Mortgage Rates

Remember, no one has a crystal ball. You will hear some predictions that say we could see interest rates increase to 7% at some point this year. You can also hear some economists say that interest rates will stabilize near the end of the second quarter for 2023, with conventional mortgage rates settling in the 5% range (Forbes, 2023). I like the latter only because it’s a more positive outlook. Rates are not as high as they were in 1982, so I think we are still doing pretty good.

Market survey of interest rates

Single Family Resale Housing Market (ABOR)

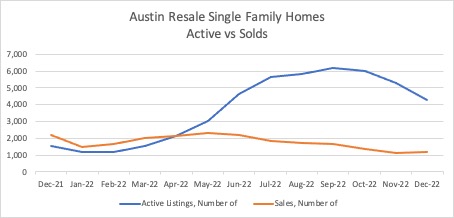

Currently, there are over 500 resale homes on Hold status in the MLS. There are also just over 4,300 resale homes currently active in our listing service when we had just over 1,200 active homes a year ago. Many sellers are waiting for the 2023 spring market to see if more buyers come out of the woodworks. This is a possibility if we see a decrease in the cost of borrowing. The Austin market has seen an increase in inventory looking at year over year numbers, however I find those stats to be a little misleading given that the market was highly active still in January of 2022.

Trend Lines

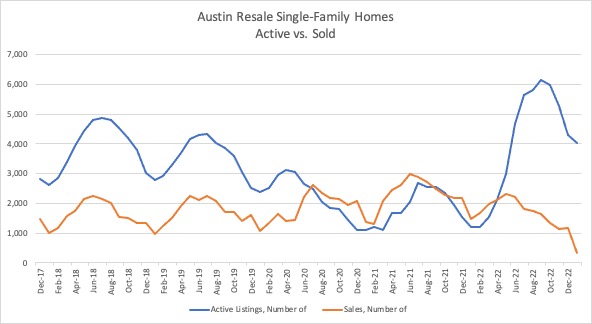

When looking at data, year over year numbers are not a clear picture of how our market is doing. It’s important to keep this in mind and look at a comparison of how homes have increased over time. A five year comparison presents a clearer picture of overall trends. The charts below provide the example of the year-over-year limitations. The first chart makes it seem like the world is falling apart. The five year comparison shows the market adjusting after wild pendulum swings. I would attribute year end listing declines to the holidays, sellers withdrawing listings, or listings placed on hold.

The charts below demonstrate typically higher inventory numbers over sales. The orange line shows the number of sales in the resale, single family homes market which ebb and flow every year. Sales tend to stay between the 1,000-2,000 range except for when it was really cheap to borrow money. The low dips in orange at the end of the second chart reflect where January’s numbers are currently. This makes sense for the time of year.

Data from ABOR |

Data from ABOR |

Investors

Investors are mostly refraining from purchasing right now. However, there are some taking advantage of a lack of buyers and higher inventory. They are keeping an eye on the market and taking action if a good opportunity does arise.

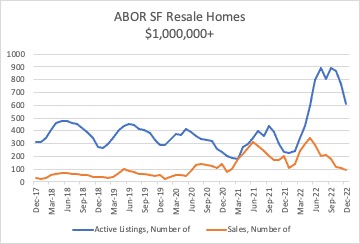

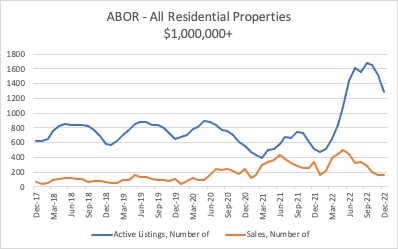

Homes Over $1 Million

Looking at homes priced over a million, the luxury market is experiencing similar trends with smaller numbers. The graphs below show the difference between single-family properties over a million and all residential properties over a million (this would include any condos or townhomes). Am I boring you yet? Overall, the Austin market has seen an increase in inventory. This does not include any off-market listings, obviously. I’m sure different brokerages and secret lists might have that information, but I’m not sharing it with you today. 🙂

Austin real estate housing market resale homes |

Austin real estate housing market all residential properties |

What does this mean for Buyers?

Buyers, you are back to having more choice than you did in 2020 and 2021. With interest rates being double what they were a year ago, it is more expensive to borrow money. You may still find yourself priced out of the market for that reason alone. Prices have definitely improved over the past year, so that might help. If the 30 year fixed rates dip into the 5%, then it would be a great time to jump back into the market as long as you can swing it financially. Jumbo loans are in the 5% range, so for homes priced over the conforming loan limits in your area, it’s a good time for you to buy as well. (Travis/Williamson/Hays Co, single-unit conforming limit is $726,200)

What does this mean for Sellers?

Sellers, you may not have a choice of when you get to list due to life changes that come your way, like job changes. For those who do have choice, you may want to look at the spring market for 2023. There is so much inventory right now, so you will have to price competitively or provide more buyer incentives to close the deal. I would also suggest you get an inspection on your home if it has been a while since the home was last inspected. This will prevent any surprises that could turn away potential buyers. When you do go on the market, it is important to listen to any feedback and adjust accordingly if suggestions are in your control.

Location, Condition, and Price

Buyers are primarily looking for 3 things in their housing market – location, condition, and price. In order to get top dollar, sellers, your home needs to be high in all three categories depending on buyer preferences. If buyers think the condition of your home is not up to their standards, then your price point cannot be at top dollar ranges. If the location of your home isn’t where buyers would prefer, then price has to come down to incentivize them. Right now, for example, Eanes ISD is in high demand. Buyers would be willing to pay more for homes that feed into this ISD. For these buyers, homes that feed into neighboring school districts will need to incentivize buyers to look their way using either a better price or by being fully renovated to modern tastes. As another example, if your home is lacking in either structural or design updates, then you will need to incentivize buyers with a more tempting price point. The main point right now is that buyers have choice, so they can follow their preferences.

Because real estate is hyper local and hyper-situational, please reach out to me for specific information regarding personal timeline to buy or sell.

*No AI was used in the writing of this article.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link