The Headlines: Is the Market Going to Crash?

The media keeps trying to push that the real estate market is crashing. They love those dramatic headlines, especially because most people these days only read the headlines. Prices have fallen over the past year, but if we have seen prices increase over the past 5-6 years, then the projected 20-25% decrease is still in the positive. For everyone who bought homes prior to 2020, then most likely you have more wiggle room for price fluctuations. Prices would need to drop 40% or more to create a real concern. Even then, remember the real estate market ebbs and flows. Austin did have a bigger growth spurt than other markets. It makes sense that bigger adjustments will happen in areas where there were larger increases, like we had in 2020-2021.

The Data:

Active, Single Family (SF) Homes: just over 7,500 active

For March: 618 SF Homes sold so far. (January SF closings – 1480; February SF closings – 1901) all as of 3/13/23

Average days on market (DOM): 70+

Months of Inventory: About 4.71 months (SF)

(Updated information since some people were asking: I did not include Under contract or pending homes initially, and with the recent homes that have sold since Monday, this number has already adjusted to 4.42 as of 3/16/23. If you include Under Contract and Pending homes in the calculations, months of inventory decreases almost by half at 2.28 months of inventory.)

Interest Rates: About 6.5% for a conventional 30 Yr Fixed; Jumbo loans about 6.15%. (MBS Data as of March 13)

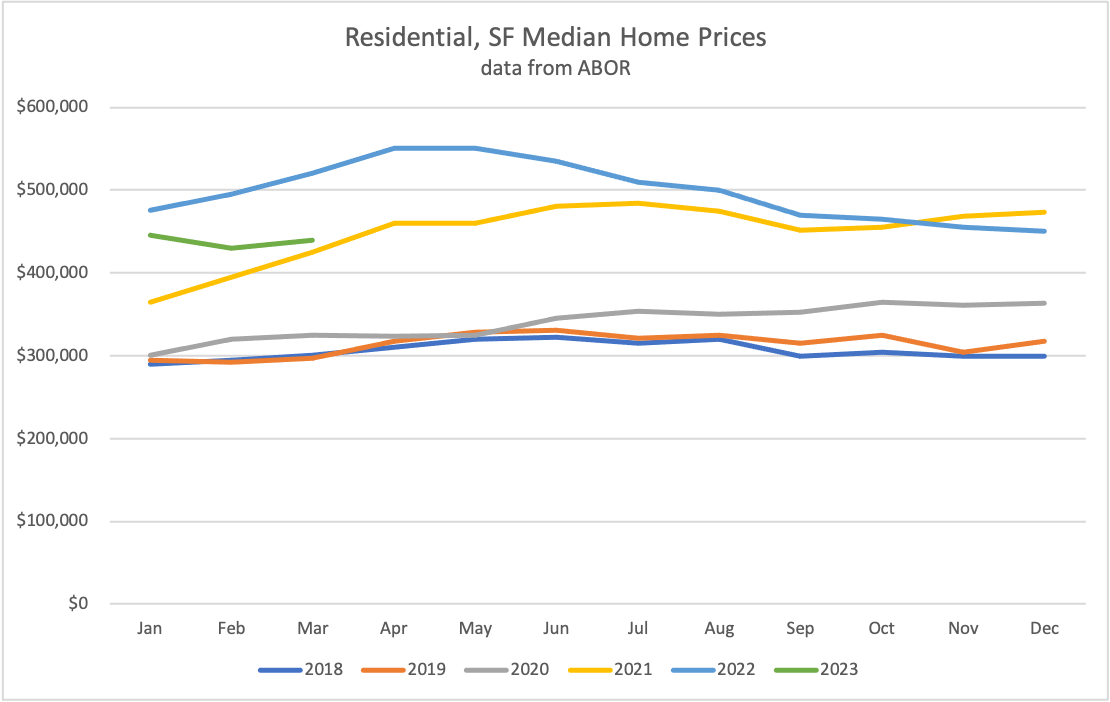

Median Home Prices

The chart below reflects how single family, median home prices have trended over the past 5 years. When someone provides you with data, it is important to know what they are referencing. In this case, I pulled data from ABOR as it stands today (March 13). I also filter for residential, single family homes that are fee simple (meaning private ownership of real estate. Condos, condo regimes, and townhomes are not included in this graph.) You can see where the home prices began increasing as 2020 progressed (grey line), carrying over into 2021 (yellow line). You can also see how the market peaked March-May of 2022, watching prices trend downwards. These numbers do combine new construction and resale homes. Not shown here, but by singling out resale homes, our median home prices fall under 2021 numbers.

Remember that those prices are based on when closings occurred. Most of the homes that have closed this month went under contract in February or even January, depending on individual contract terms. The closed price reflects what was happening in the market when the home went under contract, not when it closes.

For example, if you go under contract today on March 13, but your house isn’t contracted to close until May 1, the market can make shifts from now until then. The closed price of your home reflects what was happening on March 13, not what was happening on May 1. This is why it was hard to tell sellers who had homes on the market in March of 2022 that the market was changing. Sold prices were reflecting homes that went under contract a month or more prior. It wasn’t until observers were able to see the data over time that the change became more evident. A seller, by just checking Zillow or reading the newspaper was not going to understand the market was changing until months after those of us in real estate were seeing. It wasn’t until the media started catching up about 5-6 months later, that sellers began to understand the higher prices they had hoped to get were long gone. Buyer preferences changed in the spring of 2022, and homes that were perceived by buyers as being dated were no longer selling for top dollar.

Sellers:

When the trifecta of a home is equitable – meaning the price of a home meets the perception of value for location and condition to a buyer – then a house will probably go under contract. As stated above, homes are typically sitting on the market for over 2 months, but some homes go under contract faster than that if the price, location, and condition all seem to match what the buyer is looking for. Some homes have even received multiple offers! You just never know with this market, but be sure to listen to what the market is telling you. The market will help you understand whether you have your home priced correctly.

If you want your home to sell quickly, make sure you price it right when you list. Pricing is KEY. As a realtor, I provide as much data as possible for the range where I think the home should be priced. Ultimately, sellers decide what they list their home for. As homes sit on the market, the odds of getting a full price offer reduce significantly, so keep that in mind as you think about pricing your home. Really look at homes that are going under contract and what buyers might have seen that made them select that house. Are there any improvements you can make to help future buyer choose your house?

Buyers:

You have choice, but you also have higher interest rates if you need to borrow money. I would caution you when looking at creative financing options. I know a lot of people are saying you can just refinance later. That’s true, but that makes the assumption that you will see lower interest rates in the future. Remember that people can project lower interest rates, but no one can guarantee lower interest rates in the future. There is no crystal ball. Make decisions on financing based on what you can do with rates as they are now, not what you hope they will be in the future. We all hope to see rates decrease, and they are projected to do so later this year. However, even the projections experts at the beginning of the year have changed their time frames for when those decreases might occur as the Fed continues to promise rate increases.

If it’s a great house, in a great location, at a great price, the house will sell faster. You might need to make a fast decision if it’s your dream home. If it needs some work, remember it could be someone else’s dream home, so do not let homes sit too long before you make an offer.

Conclusion:

Real estate is not a consistent mover, so it’s important to make as wise decisions as possible with the information we have today while also looking at projections for tomorrow. The market will change. If you are thinking about what you want your real estate life to look like in a year, let’s map out a plan together now. Reach out for a consultation today.

Stay tuned next week for an update on the Luxury Market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link