The 2022 market started off with a rollover from 2021. However, in March, we saw the Austin real estate market peak. Since then, the market has been on a path to normalizing after coming off the high of 2020 and 2021 when it was cheaper to borrow money. With higher interest rates, inflation and talks of recession, there were a lot of economic and global factors impacting how buyers reacted in the real estate scene. With all of these changes happening at an unexpectedly fast pace, buyers stepped back. They hardly had time to adjust to one change before another change came along. To price better, comps need to come from active listings more so than houses that recently closed because those homes went under contract in a different market. Inventory started increasing, and currently we have more active listings than we have had in years.

Chasing the market?

With this slow down, houses sat on the market longer if they didn’t adjust accordingly to the current prices. This was hard to do even for sellers because of the fast pace in the changes. Some people could not stay ahead and ended up chasing the market which was difficult to avoid. Now, in October, buyers seem to be acclimating to the new rates and sellers are seeing 2021 prices are no longer reasonable. Buyers have more time and choice, and sellers have to offer more offer more incentives to bring buyers to the table, like offering to buy down buyers’ interest rates.

What price point do you want to sell your home?

Since about May, I have been telling my sellers that buyers want move-in ready homes, so if your house is 15 years or older and it still looks the same as it did when it was built, it might be time for some renovations. To price better, comps need to come from active listings more so than houses that recently closed because those homes went under contract in a different market. The characteristics of this market are tipping towards buyers, so it’s leading many local realtors to say we are sliding into a buyers’ market, if we are not already there. In Hays, Bastrop, and Caldwell Counties, we actually saw home sales increase, while counties like Travis and Williamson saw sales decrease according to ABOR’s September data.

Rest of the year

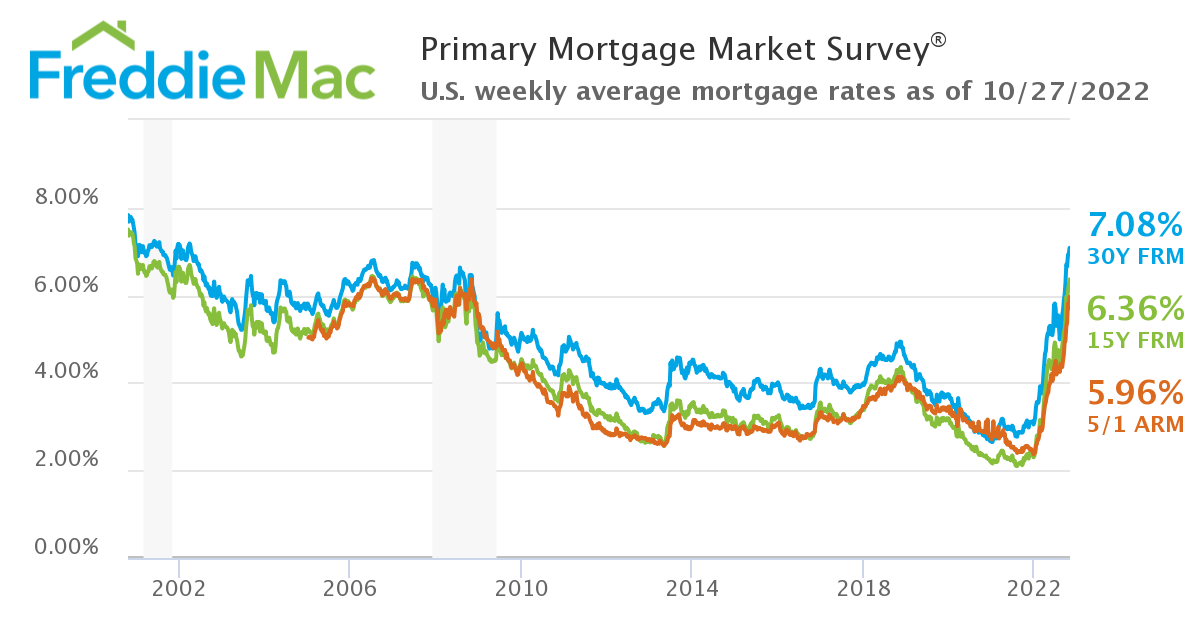

As we look ahead, we know things tend to pause during times of major elections, which early voting just started this week. People want to wait and see what happens there. With more talks of recession, some experts are predicting that we could see a slow down in interest rate hikes that would help adjust mortgage rates, but that won’t happen until further into 2023. Don’t expect to see mortgage rates in the 2s and 3s though.

Throughout 2022, we still saw homes appreciate at a much more normal pace in Austin, which could continue into 2023, but some Austin sub-markets could see slight depreciation. This is somewhat difficult to predict with so much going on currently in our nation and around the world. I will keep an eye on the market and keep clients updated of the changes through my annual real estate reviews. If you are reading doom and gloom in the news, please speak to a local real estate professional who has access to the your market’s data and can tell you what is really happening in your neighborhood.

Here is Fannie Mae’s forecast into 2023, but we are already slight above what they forecasted for fourth quarter. If we see some easing from the Fed soon, then that number would be more accurate.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link