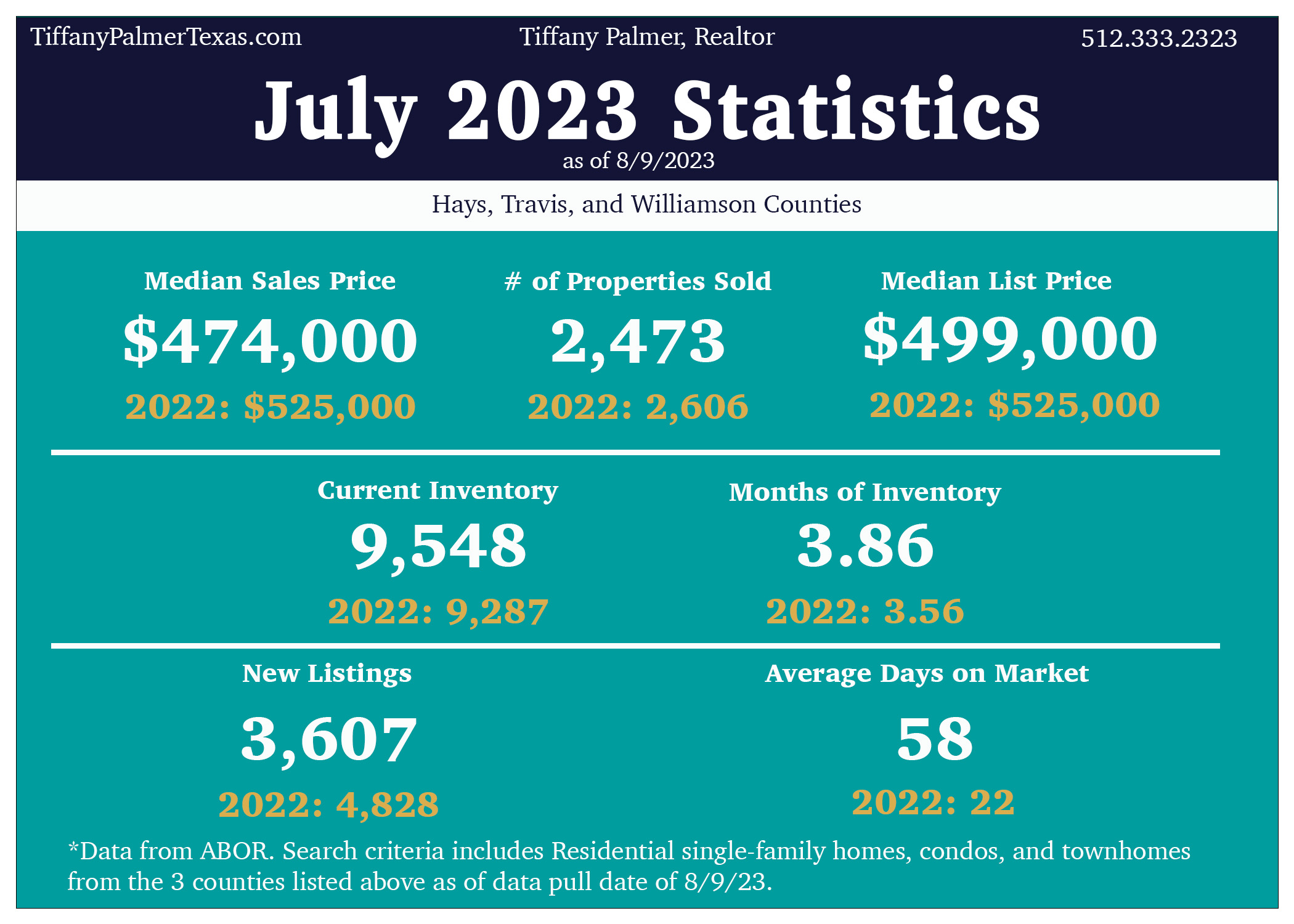

July 2023 Market Update

Preliminary numbers from ABOR’s data are reflecting the slower market we have experienced over the summer. Not to say that homes are not selling – they are. Typical seasonality trends are still present, where sales slow during later summer months. With inflation showing a slight increase today (8/10/23), the Federal Reserve may want to do another federal funds rate increase in the fall, which could indirectly impact mortgage rates negatively. A seasonal lift that normally occurs during September and October could be impact affordability as well if we see mortgage rates increase again.

Even with under 4 months of inventory, many analysts are saying we still remain in a balanced market overall. You can zone in on zip codes and neighborhoods in the Austin area to find some differences as to whether a specific area is swaying more towards buyers or sellers; however, with over 9,000 active listings on the market, buyers do have choice. Homes are sitting on the market longer compared to last year. The median list to closed price ratio is around 98%, or a little lower (range of 95-98%). There have been a some instances of homes going under contract with multiple offers, but that is not a general statement for the market.

It takes a depth of analysis to understand the current value of a home in today’s market (not what it was at the height experienced 2 years ago). Price a home too low, and the seller could potentially lose out on equity. Price a home too high, and it will not sell. Pricing is key to getting a home sold, but not manipulatively low, making the market seem more active than it actually is. Pricing slightly under value is good if you are truly trying to incentivize buyers. Offering seller concessions to help a buyer lower interest rates can also increase eyes on your home.

As a buyer, if you can weather the current interest rates, or put money down to lower the rate, then it’s a good time to buy a home. (You have to calculate your break-even point to understand if it is worth it to buy down your rate). There are some great deals around town.

New construction is helping first-time buyers enter the market, but remember to take me with you when you go to visit new home communities. There is a lot involved in working with a builder that you may not understand. Yes, you can speak with the salespeople and the construction manager, but they all represent the builder. Make sure you have representation for yourself when you go.

If you have questions or want to know data for your specific neighborhood, contact me today!

If you are not needing to be active in the market right now, please pass my name along to family and friends who do need to buy or sell.

Things to know about these numbers:

- Counties – Travis, Williamson, Hays

- Properties – Single family homes, Townhomes, Condos

- All Price Points

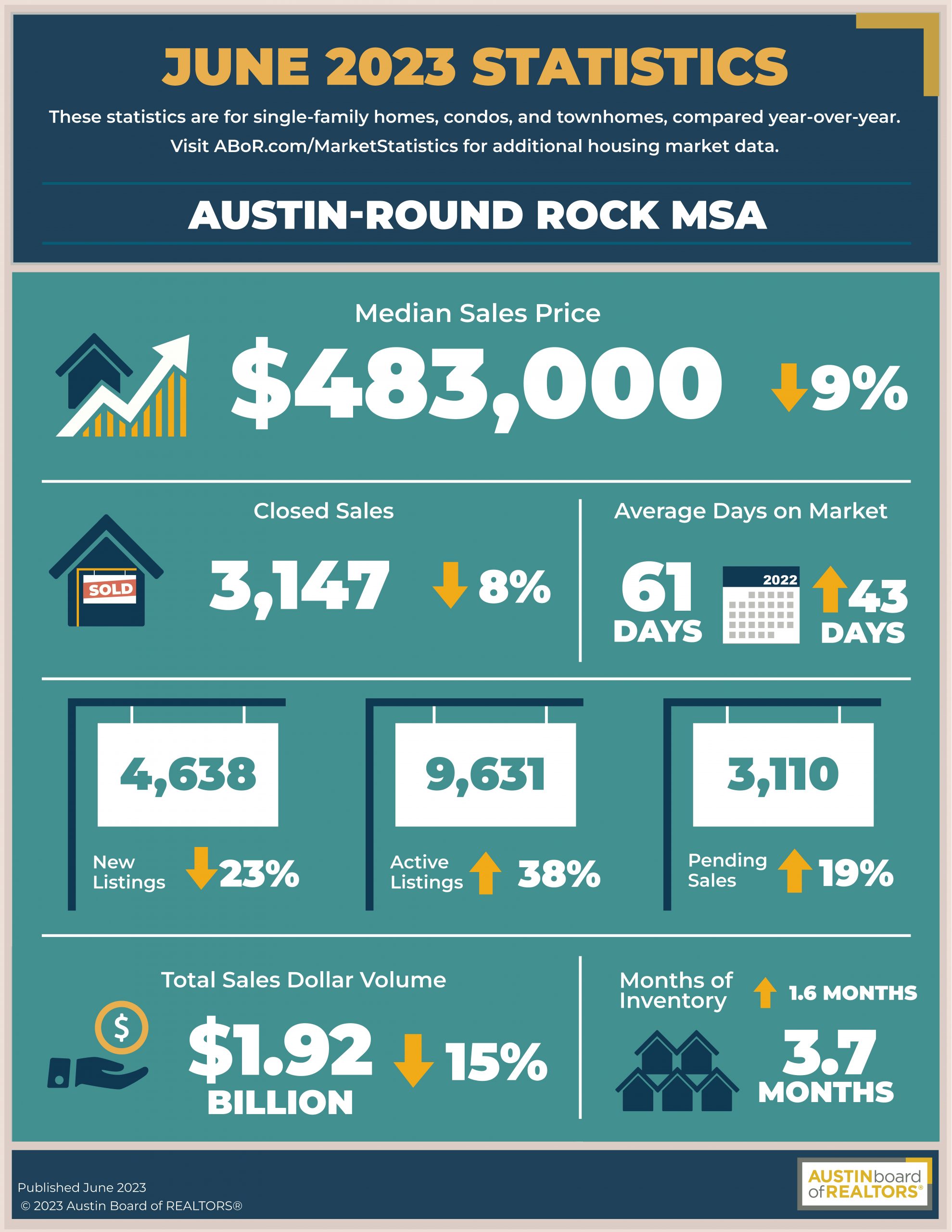

June 2023 Market Stats

An explanation of the June 2023 Market Stats for the Austin area:

Let’s dive into the fascinating world of real estate metrics and explore the correlation between various factors that play a crucial role in the buying and selling process. Whether you’re a buyer or a seller, understanding these metrics is vital in making well-informed decisions and maximizing the potential of your real estate endeavors.

Let’s start by examining the Months of Inventory, which currently stands at 3.7 months for the Austin MLS area. This metric represents the number of months it would take to sell all the available inventory on the market if no new listings were added. A lower number indicates a seller’s market, where demand outpaces supply, leading to potentially higher prices. Conversely, a higher number suggests a buyer’s market, where supply exceeds demand, giving buyers more negotiating power.

This MOI number is a year over year increase of 1.6 months. This substantial rise indicates a shifting market dynamic, transitioning from a seller’s market to a more balanced or even a buyer’s market. This change is offering buyers more options and potentially more favorable terms.

Looking at Average Days on Market, the Austin area currently stands at 61 days. This metric provides valuable insights into the pace at which homes are being sold. A lower number suggests a fast-moving market, where properties are in high demand and tend to sell quickly. Conversely, a higher number indicates a slower market, where homes may linger on the market for a more extended period, potentially necessitating strategic pricing and marketing strategies.

The Median sales price for June is $483,000. This metric represents the middle point of all the sold prices in the Austin area. It gives buyers and sellers an idea of the general price range they can expect when entering the market. A higher median sold price often signifies a more affluent neighborhood or an area with high demand and limited supply.

The number of closed sales is down by 8% from last year. We are also seeing a lower number of new listings overall, but that could be reflective of a slower seasonal summer market. There is still activity in the market as reflected in the number of pending sales, which is a 19% increase over last June.

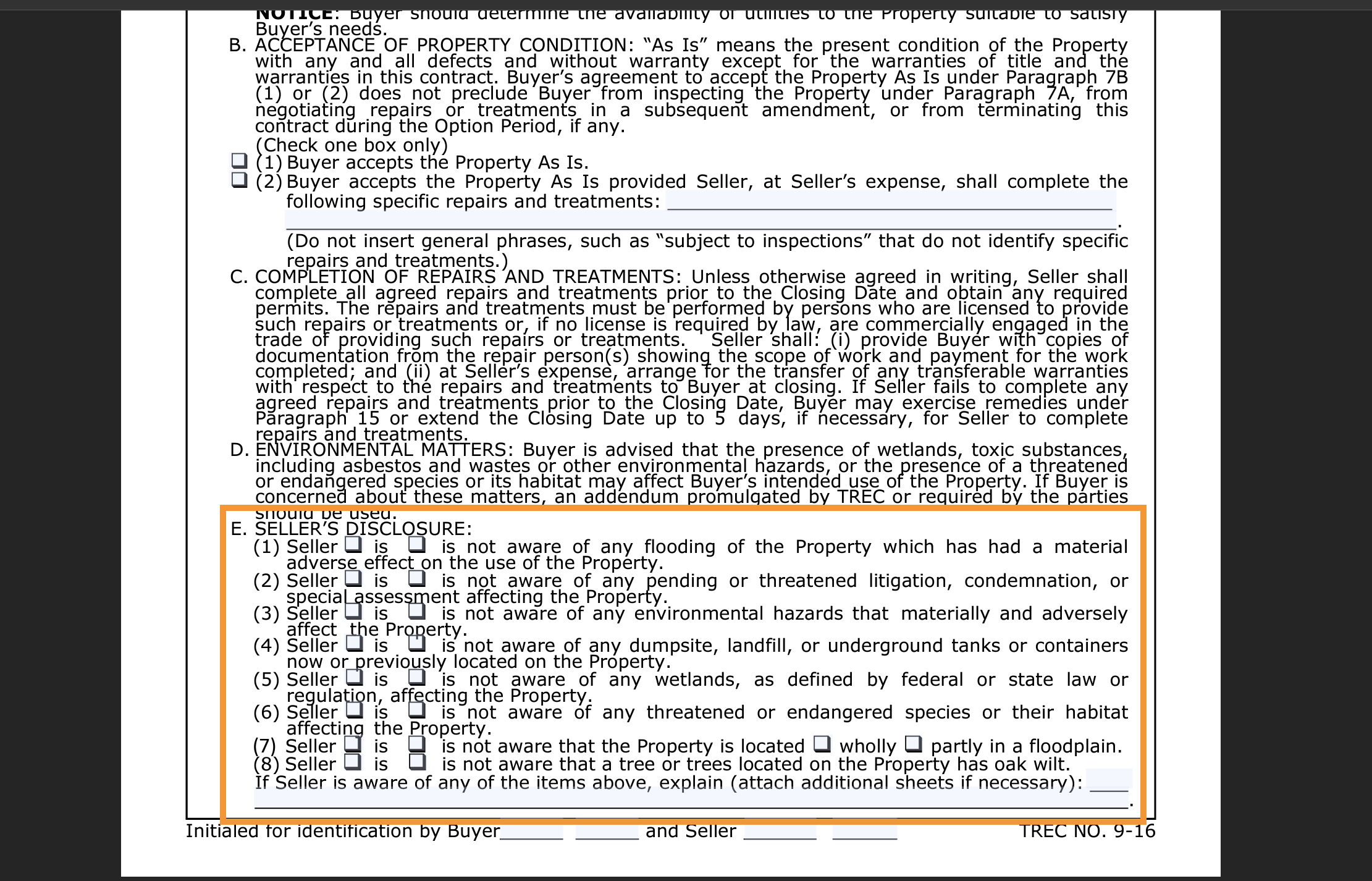

Unimproved Land Contract: Seller’s Disclosure

Earlier this year, I had a situation representing a buyer on a land deal. While working on the offer, I noticed the promulgated unimproved land contract included a section for the Seller’s Disclosure. I drafted the offer, and let my clients review it. However, I did not have them sign it. I sent the unsigned offer to the listing agent and let her know we needed the Seller’s Disclosure portion completed first before my clients would sign it. She was unaware of this section and was hesitant about even asking her client to complete it. I had to insist that we could not submit an offer that was signed by the buyers until the seller completed this portion. The seller, of course, was resistant as well, since the listing agent had not been able to prepare him about property disclosure for unimproved land. I put my foot down and said they had to complete it before we could send in the full offer. Eventually, we were able work everything out, and my clients ended up buying the property.

It is important that I look out for the best interests of my clients. It would not have been wise to have the clients sign the offer without knowing some of the information that the seller’s disclosure provides. Even though a buyer needs to do their own research on the land, the seller is also obligated to disclose what they know about the property. I’m not sure that I would have slapped the disclosure in the middle of the contract like that, but I’m not a lawyer. If you come across this same situation, I would suggest a listing agent add a completed and initialed page of the contract with the Seller’s Disclosure section to their listing documents. Buyers agents, if the page is not already provided, I would suggest sending just that page with the Seller’s Disclosure section to the listing agent, informing them that it needs to be completed by the seller before you have your buyers sign their offer.

If you have questions about buying or selling land in Texas, reach out to us here

To preview the form in question: https://www.trec.texas.gov/forms/unimproved-property-contract-0

Market Update as of March 13, 2023

The Headlines: Is the Market Going to Crash?

The media keeps trying to push that the real estate market is crashing. They love those dramatic headlines, especially because most people these days only read the headlines. Prices have fallen over the past year, but if we have seen prices increase over the past 5-6 years, then the projected 20-25% decrease is still in the positive. For everyone who bought homes prior to 2020, then most likely you have more wiggle room for price fluctuations. Prices would need to drop 40% or more to create a real concern. Even then, remember the real estate market ebbs and flows. Austin did have a bigger growth spurt than other markets. It makes sense that bigger adjustments will happen in areas where there were larger increases, like we had in 2020-2021.

The Data:

Active, Single Family (SF) Homes: just over 7,500 active

For March: 618 SF Homes sold so far. (January SF closings – 1480; February SF closings – 1901) all as of 3/13/23

Average days on market (DOM): 70+

Months of Inventory: About 4.71 months (SF)

(Updated information since some people were asking: I did not include Under contract or pending homes initially, and with the recent homes that have sold since Monday, this number has already adjusted to 4.42 as of 3/16/23. If you include Under Contract and Pending homes in the calculations, months of inventory decreases almost by half at 2.28 months of inventory.)

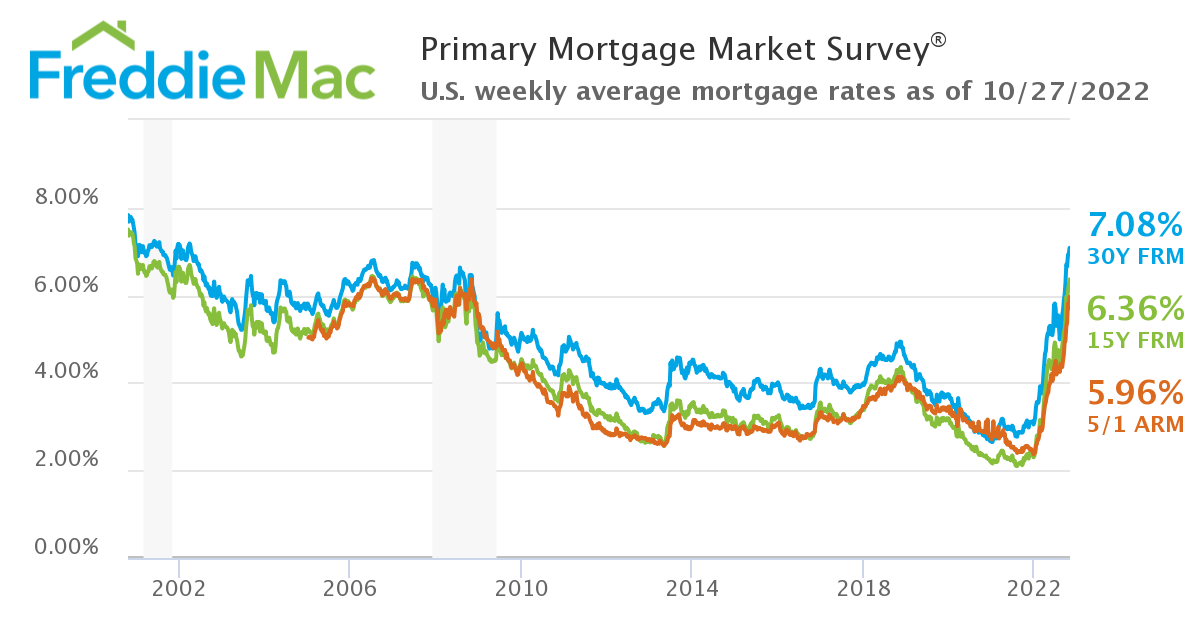

Interest Rates: About 6.5% for a conventional 30 Yr Fixed; Jumbo loans about 6.15%. (MBS Data as of March 13)

Median Home Prices

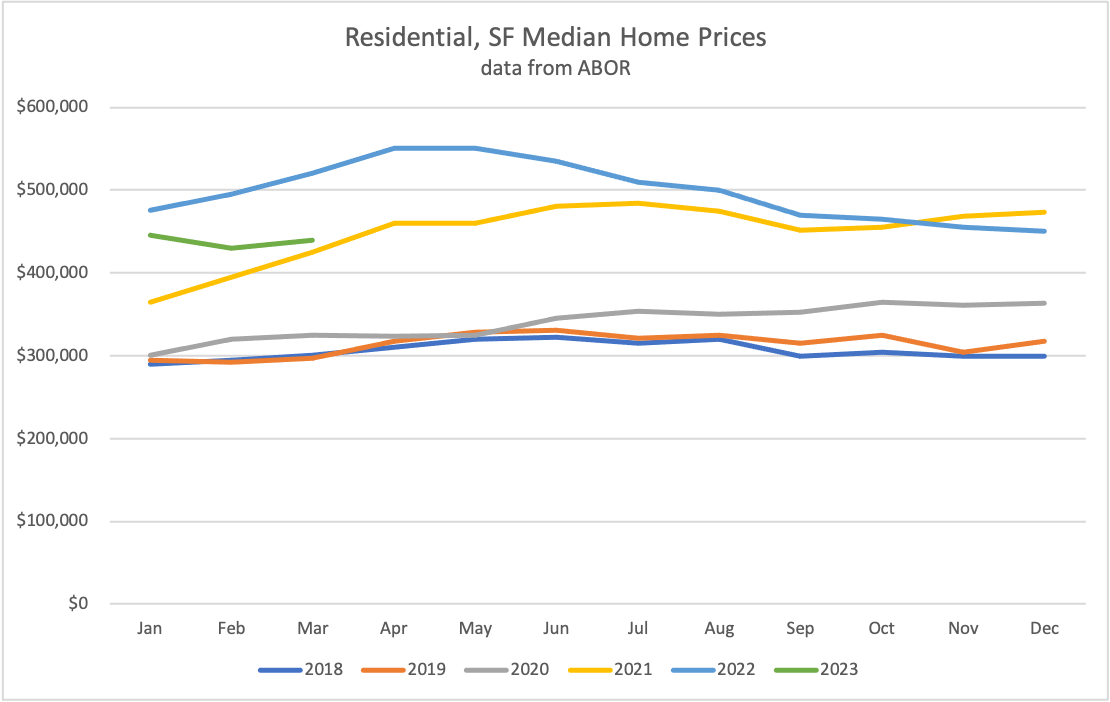

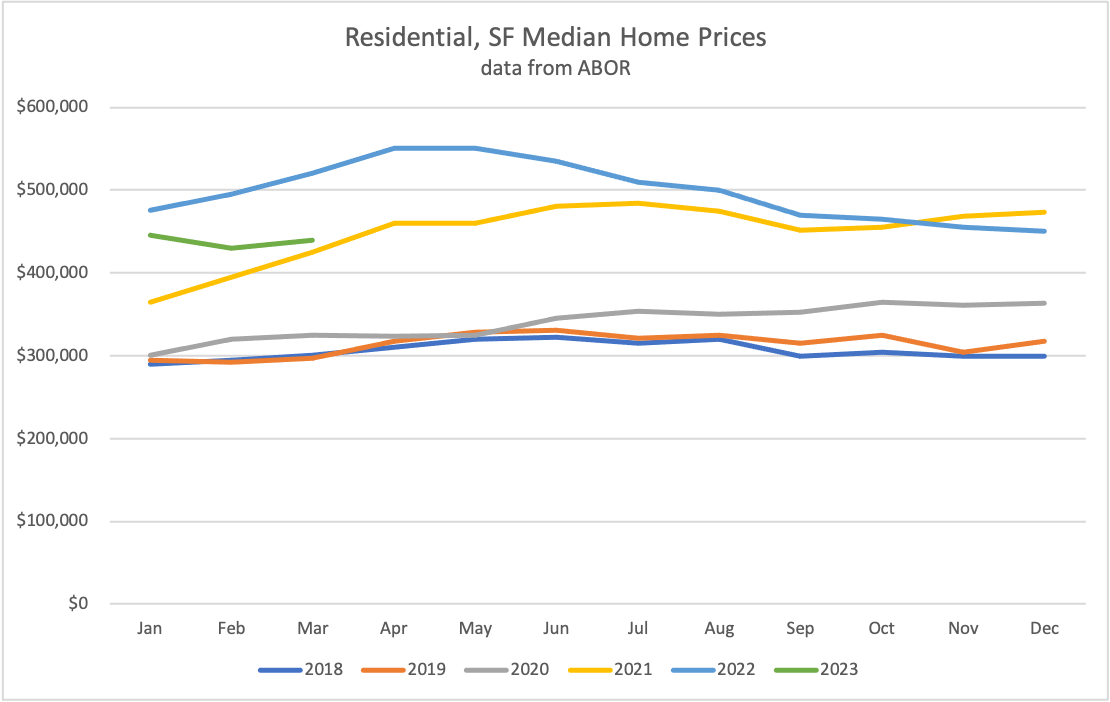

The chart below reflects how single family, median home prices have trended over the past 5 years. When someone provides you with data, it is important to know what they are referencing. In this case, I pulled data from ABOR as it stands today (March 13). I also filter for residential, single family homes that are fee simple (meaning private ownership of real estate. Condos, condo regimes, and townhomes are not included in this graph.) You can see where the home prices began increasing as 2020 progressed (grey line), carrying over into 2021 (yellow line). You can also see how the market peaked March-May of 2022, watching prices trend downwards. These numbers do combine new construction and resale homes. Not shown here, but by singling out resale homes, our median home prices fall under 2021 numbers.

Remember that those prices are based on when closings occurred. Most of the homes that have closed this month went under contract in February or even January, depending on individual contract terms. The closed price reflects what was happening in the market when the home went under contract, not when it closes.

For example, if you go under contract today on March 13, but your house isn’t contracted to close until May 1, the market can make shifts from now until then. The closed price of your home reflects what was happening on March 13, not what was happening on May 1. This is why it was hard to tell sellers who had homes on the market in March of 2022 that the market was changing. Sold prices were reflecting homes that went under contract a month or more prior. It wasn’t until observers were able to see the data over time that the change became more evident. A seller, by just checking Zillow or reading the newspaper was not going to understand the market was changing until months after those of us in real estate were seeing. It wasn’t until the media started catching up about 5-6 months later, that sellers began to understand the higher prices they had hoped to get were long gone. Buyer preferences changed in the spring of 2022, and homes that were perceived by buyers as being dated were no longer selling for top dollar.

Sellers:

When the trifecta of a home is equitable – meaning the price of a home meets the perception of value for location and condition to a buyer – then a house will probably go under contract. As stated above, homes are typically sitting on the market for over 2 months, but some homes go under contract faster than that if the price, location, and condition all seem to match what the buyer is looking for. Some homes have even received multiple offers! You just never know with this market, but be sure to listen to what the market is telling you. The market will help you understand whether you have your home priced correctly.

If you want your home to sell quickly, make sure you price it right when you list. Pricing is KEY. As a realtor, I provide as much data as possible for the range where I think the home should be priced. Ultimately, sellers decide what they list their home for. As homes sit on the market, the odds of getting a full price offer reduce significantly, so keep that in mind as you think about pricing your home. Really look at homes that are going under contract and what buyers might have seen that made them select that house. Are there any improvements you can make to help future buyer choose your house?

Buyers:

You have choice, but you also have higher interest rates if you need to borrow money. I would caution you when looking at creative financing options. I know a lot of people are saying you can just refinance later. That’s true, but that makes the assumption that you will see lower interest rates in the future. Remember that people can project lower interest rates, but no one can guarantee lower interest rates in the future. There is no crystal ball. Make decisions on financing based on what you can do with rates as they are now, not what you hope they will be in the future. We all hope to see rates decrease, and they are projected to do so later this year. However, even the projections experts at the beginning of the year have changed their time frames for when those decreases might occur as the Fed continues to promise rate increases.

If it’s a great house, in a great location, at a great price, the house will sell faster. You might need to make a fast decision if it’s your dream home. If it needs some work, remember it could be someone else’s dream home, so do not let homes sit too long before you make an offer.

Conclusion:

Real estate is not a consistent mover, so it’s important to make as wise decisions as possible with the information we have today while also looking at projections for tomorrow. The market will change. If you are thinking about what you want your real estate life to look like in a year, let’s map out a plan together now. Reach out for a consultation today.

Stay tuned next week for an update on the Luxury Market.

What is luxury?

What is luxury?

The traditional definitions of luxury typically referred to the highest priced products or services. Webster defines it as “a condition of abundance or great ease and comfort”. Or, “an indulgence in something that provides pleasure, satisfaction, or ease” (merriam-webster.com). In other sources, luxury items are defined as products or services that are not truly necessary. Luxury may always mean expensive things to some, but for others, that definition has a newer meaning.

Time. Truth. Trust.

After the pandemic, the definition of luxury adapted for the younger generations. It has not completely been erased, but has phased into something new. Time is an extremely limited resource for all of us, but still a part of the traditional meaning for luxury, especially those with higher net worths (as was previously perceived). However, Jared Weiner from The Future Hunters called the new focus for luxury to be the “Three T’s” (Forbes.com). Time is the first of the three, but different because the way people want to spend their time has shifted with their priorities.

The pandemic then introduced these second two terms as new aspects to the luxury perspective. Truth – which refers to making a product or service true to the customer’s perspective and who they are. And Trust – meaning that a customer requires authenticity from the company or it’s representatives of the desired product or service.

Tiffany Palmer Luxury

Tiffany Palmer as a realtor and Coldwell Banker Luxury Property Specialist provides all three of these qualities to her clients. She recognizes time is a luxury for everyone, putting systems in place to ensure time is not wasted. Tiffany values truth, and as a fiduciary, she keeps your interests above her own. Trust is what Tiffany believes is a two way street, but she initiates that process by being her authentic self with each of her clients. Tiffany’s laid-back luxury style helps those around her feel comfortable throughout the home buying and selling process. However, clients feel confident knowing that she is working hard for them behind the scenes.

Tiffany works with clients of all home stages, from entry-level to higher end homes. Her desired clients understand Tiffany’s values and trust her processes. If you want to see how Tiffany can help you, reach out here!

2023 Real Estate Housing Market Update – Austin Area

Austin Area Real Estate Market Update 2023*

Market Outlook

The Austin real estate market is gearing up for 2023 in 2008 fashion. Mortgage rates are hovering around the mid 6s for 30 year fixed conventional loans. The Federal Reserve is promising a teensy tiny federal funds rate increase because inflation is slowly improving, which will indirectly impact mortgage rates. The financial market is expecting some volatility until the economy outlook is clearer (Forbes, 2023).

Mortgage Rates

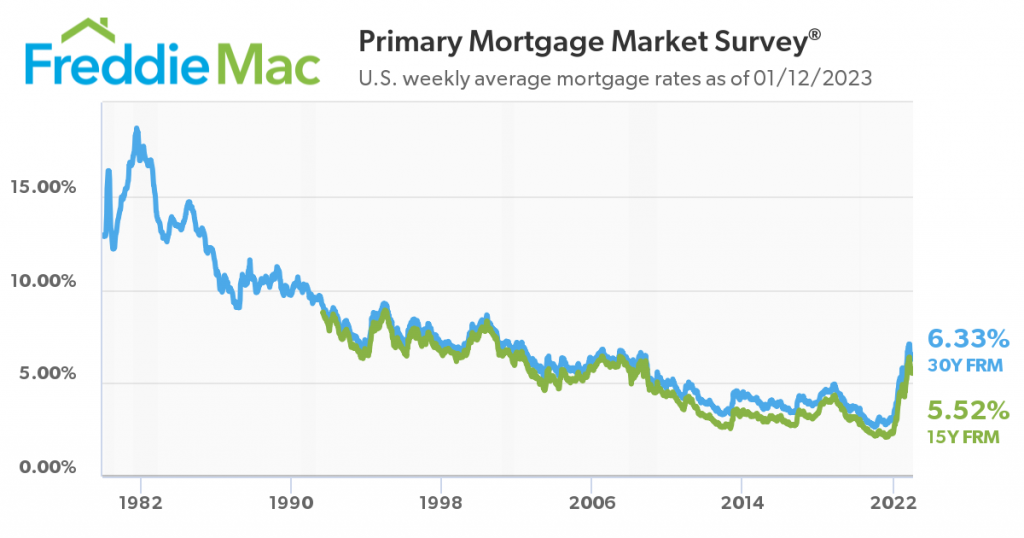

Remember, no one has a crystal ball. You will hear some predictions that say we could see interest rates increase to 7% at some point this year. You can also hear some economists say that interest rates will stabilize near the end of the second quarter for 2023, with conventional mortgage rates settling in the 5% range (Forbes, 2023). I like the latter only because it’s a more positive outlook. Rates are not as high as they were in 1982, so I think we are still doing pretty good.

Market survey of interest rates

Single Family Resale Housing Market (ABOR)

Currently, there are over 500 resale homes on Hold status in the MLS. There are also just over 4,300 resale homes currently active in our listing service when we had just over 1,200 active homes a year ago. Many sellers are waiting for the 2023 spring market to see if more buyers come out of the woodworks. This is a possibility if we see a decrease in the cost of borrowing. The Austin market has seen an increase in inventory looking at year over year numbers, however I find those stats to be a little misleading given that the market was highly active still in January of 2022.

Trend Lines

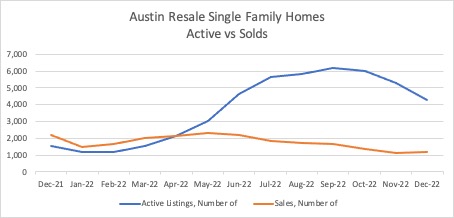

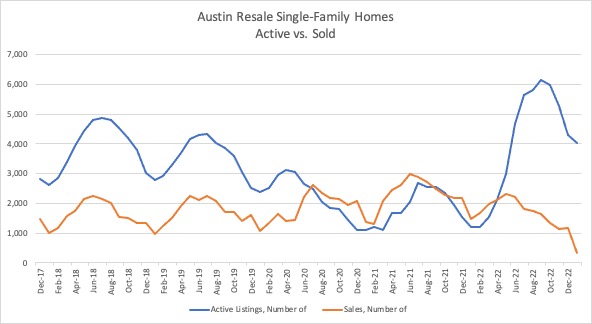

When looking at data, year over year numbers are not a clear picture of how our market is doing. It’s important to keep this in mind and look at a comparison of how homes have increased over time. A five year comparison presents a clearer picture of overall trends. The charts below provide the example of the year-over-year limitations. The first chart makes it seem like the world is falling apart. The five year comparison shows the market adjusting after wild pendulum swings. I would attribute year end listing declines to the holidays, sellers withdrawing listings, or listings placed on hold.

The charts below demonstrate typically higher inventory numbers over sales. The orange line shows the number of sales in the resale, single family homes market which ebb and flow every year. Sales tend to stay between the 1,000-2,000 range except for when it was really cheap to borrow money. The low dips in orange at the end of the second chart reflect where January’s numbers are currently. This makes sense for the time of year.

Data from ABOR |

Data from ABOR |

Investors

Investors are mostly refraining from purchasing right now. However, there are some taking advantage of a lack of buyers and higher inventory. They are keeping an eye on the market and taking action if a good opportunity does arise.

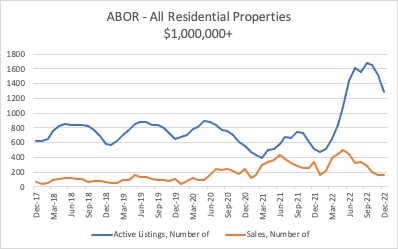

Homes Over $1 Million

Looking at homes priced over a million, the luxury market is experiencing similar trends with smaller numbers. The graphs below show the difference between single-family properties over a million and all residential properties over a million (this would include any condos or townhomes). Am I boring you yet? Overall, the Austin market has seen an increase in inventory. This does not include any off-market listings, obviously. I’m sure different brokerages and secret lists might have that information, but I’m not sharing it with you today. 🙂

Austin real estate housing market resale homes |

Austin real estate housing market all residential properties |

What does this mean for Buyers?

Buyers, you are back to having more choice than you did in 2020 and 2021. With interest rates being double what they were a year ago, it is more expensive to borrow money. You may still find yourself priced out of the market for that reason alone. Prices have definitely improved over the past year, so that might help. If the 30 year fixed rates dip into the 5%, then it would be a great time to jump back into the market as long as you can swing it financially. Jumbo loans are in the 5% range, so for homes priced over the conforming loan limits in your area, it’s a good time for you to buy as well. (Travis/Williamson/Hays Co, single-unit conforming limit is $726,200)

What does this mean for Sellers?

Sellers, you may not have a choice of when you get to list due to life changes that come your way, like job changes. For those who do have choice, you may want to look at the spring market for 2023. There is so much inventory right now, so you will have to price competitively or provide more buyer incentives to close the deal. I would also suggest you get an inspection on your home if it has been a while since the home was last inspected. This will prevent any surprises that could turn away potential buyers. When you do go on the market, it is important to listen to any feedback and adjust accordingly if suggestions are in your control.

Location, Condition, and Price

Buyers are primarily looking for 3 things in their housing market – location, condition, and price. In order to get top dollar, sellers, your home needs to be high in all three categories depending on buyer preferences. If buyers think the condition of your home is not up to their standards, then your price point cannot be at top dollar ranges. If the location of your home isn’t where buyers would prefer, then price has to come down to incentivize them. Right now, for example, Eanes ISD is in high demand. Buyers would be willing to pay more for homes that feed into this ISD. For these buyers, homes that feed into neighboring school districts will need to incentivize buyers to look their way using either a better price or by being fully renovated to modern tastes. As another example, if your home is lacking in either structural or design updates, then you will need to incentivize buyers with a more tempting price point. The main point right now is that buyers have choice, so they can follow their preferences.

Because real estate is hyper local and hyper-situational, please reach out to me for specific information regarding personal timeline to buy or sell.

*No AI was used in the writing of this article.

October Market Update 2022

The 2022 market started off with a rollover from 2021. However, in March, we saw the Austin real estate market peak. Since then, the market has been on a path to normalizing after coming off the high of 2020 and 2021 when it was cheaper to borrow money. With higher interest rates, inflation and talks of recession, there were a lot of economic and global factors impacting how buyers reacted in the real estate scene. With all of these changes happening at an unexpectedly fast pace, buyers stepped back. They hardly had time to adjust to one change before another change came along. To price better, comps need to come from active listings more so than houses that recently closed because those homes went under contract in a different market. Inventory started increasing, and currently we have more active listings than we have had in years.

Chasing the market?

With this slow down, houses sat on the market longer if they didn’t adjust accordingly to the current prices. This was hard to do even for sellers because of the fast pace in the changes. Some people could not stay ahead and ended up chasing the market which was difficult to avoid. Now, in October, buyers seem to be acclimating to the new rates and sellers are seeing 2021 prices are no longer reasonable. Buyers have more time and choice, and sellers have to offer more offer more incentives to bring buyers to the table, like offering to buy down buyers’ interest rates.

What price point do you want to sell your home?

Since about May, I have been telling my sellers that buyers want move-in ready homes, so if your house is 15 years or older and it still looks the same as it did when it was built, it might be time for some renovations. To price better, comps need to come from active listings more so than houses that recently closed because those homes went under contract in a different market. The characteristics of this market are tipping towards buyers, so it’s leading many local realtors to say we are sliding into a buyers’ market, if we are not already there. In Hays, Bastrop, and Caldwell Counties, we actually saw home sales increase, while counties like Travis and Williamson saw sales decrease according to ABOR’s September data.

Rest of the year

As we look ahead, we know things tend to pause during times of major elections, which early voting just started this week. People want to wait and see what happens there. With more talks of recession, some experts are predicting that we could see a slow down in interest rate hikes that would help adjust mortgage rates, but that won’t happen until further into 2023. Don’t expect to see mortgage rates in the 2s and 3s though.

Throughout 2022, we still saw homes appreciate at a much more normal pace in Austin, which could continue into 2023, but some Austin sub-markets could see slight depreciation. This is somewhat difficult to predict with so much going on currently in our nation and around the world. I will keep an eye on the market and keep clients updated of the changes through my annual real estate reviews. If you are reading doom and gloom in the news, please speak to a local real estate professional who has access to the your market’s data and can tell you what is really happening in your neighborhood.

Here is Fannie Mae’s forecast into 2023, but we are already slight above what they forecasted for fourth quarter. If we see some easing from the Fed soon, then that number would be more accurate.

New website coming for Tiffany Palmer

I will be working on a new website for Tiffany Palmer, real estate extraordinaire. For now, I am using this new website, which should be SSL shortly. It takes a little while to get the certificate. I’m super excited to add a blog section that with regular updates. I will also post about current real estate news and other local happenings. Use the new website to search directly for properties and save them. I enjoyed having someone else maintain a site, but not at the expense of control loss. It was taking multiple times to get a response or a simple request to be fulfilled. One of those requests was to have a blog. They told me I didn’t need one, but that should not be the point. I want one. haha!

Stay tuned to more updates on all things real estate, and don’t forget to follow Tiffany Palmer on Instagram – Tiffany Palmer. If you would like to know more about me, read my profile here

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link